Digital to Analog alignment @ Lowell Nordics

Service design, UI/UX

Customer service is the “make or break” for any given credit management business. That goes for Lowell Nordics as well. In addition to the goal of becoming debt-free as effectively as possible, customers do expect other things from a credit management company. Satisfying those expectations relies on customer service experts (CSE’s) the most. Every other means the business communicates with its customers comes second.

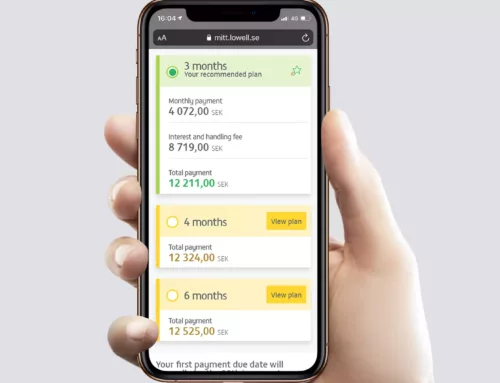

The CSE’s role is traditionally an analog one. To complement this analog service, Lowell has a digital self-service platform for customers named My Lowell. Here, customers can manage their credit cases and live-chat with CSE’s. Yet, the alignment level of this digital service to analog has not been at a satisfactory level for Lowell Nordics. At least not until I started this project.

To ensure a satisfactory level for alignment between digital to analog (D2A), I started from scratch. The first thing first, understanding what goes on at the relevant touchpoints. For this, I recreated the service blueprint canvas that I found suitable enough from the “Service Design: From Insight to Implementation” book. Filling this canvas requires scaling for any given business. It matters where and to what aspect the analyst must focus. So for this project alone, I put the magnifying glass on Sweden and towards what we call the utility industry.

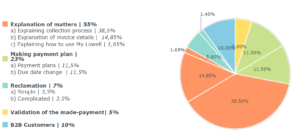

After the canvas filled enough to reveal where to focus further, I jumped into interviewing CSEs. CSEs are like gold mines for understanding what Lowell’s customer service is all about. They are like the troopers on the ground every day, ready-for-action at all times, right at the front. After completing the open interviews, I started to code them. This coding revealed the domains where CSEs put the most effort, spending their FTEs. Seeing the digital service from this perspective proved the digital service was indeed not aligned well with the analog.

What came next was not only driven by data but also was based on a mindset. That is the mindset of being the ambassador of customer/user empowerment. Lowell’s customers are free to learn more about the collection process by their effort. Yet, the convenience was not there. Additionally, we also realized, although our CSEs spend the majority of their time explaining the nuances of the debt-collection process to our customers, there is no source for customers to handle this by themselves.

All this gave birth to a new service within My Lowell: My Lowell Knowledge Base. With this, I aimed to empower our customers at the exact moment it matters. Sharing further information may cause some problems for me, but I would be more than happy to talk about this in person.